Latest Version

10.61.0

March 24, 2025

Send Money, Split Expenses

Finance

iOS

415.3 MB

0

Free

Report a Problem

More About Venmo

Venmo: The Ultimate Guide to Sending, Splitting, and Spending Money

Venmo has become one of the most popular peer-to-peer payment apps, with over 83 million users taking advantage of its seamless money transfer services. Whether you're paying rent, splitting a bill, or making purchases, Venmo makes transactions fast, convenient, and social. But is it the right choice for you? Let’s dive into its features, benefits, and what real users are saying.

Key Features of Venmo

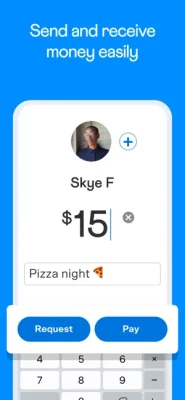

1. Send and Receive Money with Ease

Venmo allows users to send and receive money instantly, whether you're splitting dinner with friends or gifting money for a birthday. Each payment comes with the option to add a note, making transactions feel more personal.

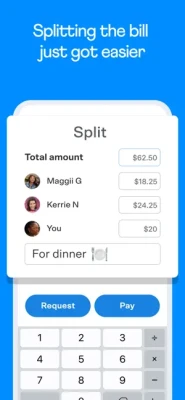

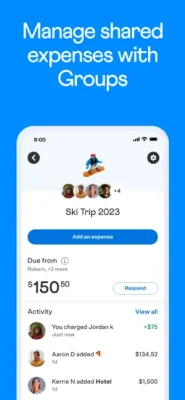

2. Split Expenses with Multiple Friends

Need to split the bill at a restaurant or pay for a group trip? Venmo makes it easy to request payments from multiple friends and customize the amount each person owes.

3. Venmo Credit Card – Get Rewarded

Venmo’s credit card offers up to 3% cash back on your top spending category. You can split purchases with Venmo friends and use it anywhere Visa® is accepted worldwide.

4. Buy Crypto with Just $1

If you're interested in cryptocurrency, Venmo lets you buy, hold, and sell digital currencies within the app. The in-app resources help beginners understand the basics, though it’s important to note that crypto prices are volatile.

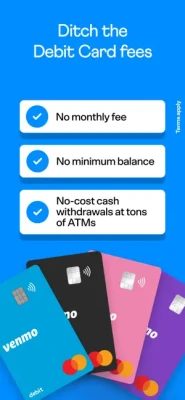

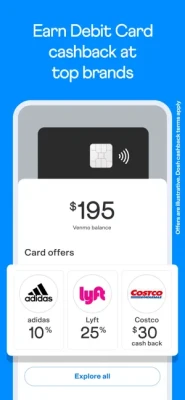

5. Venmo Debit Card – Spend on the Go

Venmo’s Mastercard® debit card allows you to spend funds directly from your Venmo balance. Plus, you can earn cashback at select retailers.

6. Venmo Teen Accounts

Parents can now set up a Venmo Teen Account for kids aged 13-17. This includes a debit card and a linked Venmo account with no minimum balance or monthly fees.

7. Business Profiles for Side Hustles

Freelancers, small business owners, and entrepreneurs can create a business profile under their existing Venmo account to accept payments from customers.

8. Pay in Stores and Online

Venmo QR codes allow users to make contactless payments at participating stores like CVS. Additionally, Venmo can be used for checkout on platforms like Uber Eats, Grubhub, and StockX.

9. Manage Your Money Efficiently

Need to cash out quickly? Venmo offers an Instant Transfer feature, allowing you to move money to your bank account within minutes. If you set up direct deposit, you could receive your paycheck up to two days early.

What Users Are Saying

Positive Experiences

Many users praise Venmo for its simplicity and reliability. One reviewer shared how Venmo provided a financial lifeline during a difficult year. The app’s intuitive design and lack of hidden fees make it a favorite among those looking for an alternative to traditional banking.

Another satisfied customer noted that the Venmo debit card helped them bridge the gap between paychecks by allowing them to access their bank funds in $10 increments without an overdraft fee.

Negative Experiences

While Venmo has plenty of fans, some users have encountered issues. A common complaint revolves around the Venmo debit card, which has been reported to randomly decline transactions despite sufficient funds. One user described an embarrassing experience where their card was declined at multiple locations, and Venmo’s customer service offered no immediate solution.

Another drawback is the lack of Apple Pay support, a feature many users would like to see implemented.

Final Thoughts: Is Venmo Right for You?

Venmo is a fantastic option for quick money transfers, social transactions, and even crypto investments. If you primarily use it for sending money and splitting bills, it’s a solid choice. However, if instant access to your funds and seamless debit card transactions are a priority, you might want to explore alternatives like PayPal or your bank’s mobile payment options.

Ultimately, Venmo remains a top contender in the world of digital payments, but its reliability depends on how you plan to use it. If you’re comfortable with occasional delays and security measures, it could be the perfect addition to your financial toolkit.

Android

Android iOS

iOS